Enhance Your Customer Experience

Provide More than Just Solar, Deliver Peace of Mind

Empower your customers with expert tax consultancy.

Add Value, Retain Clients!

Partnering with STC Brings Value for Your Clients

Unlock Additional Tax Benefits

Simplify Complex Tax Paperwork

Ensure Faster ROI for Clients

Sustain Long-Term Client Loyalty

OUR PROCESS

A Clear Route to Enhanced Value

Begin Your Journey

Kickstart with a Tailored Consultation

Let's start with a consultation to understand your Solar Company's needs and goals better.

We'll assess your needs and discuss the scope of our solar tax services, potential solutions, and the expected outcomes that ultimately will help you close more deals over your competitors and improve client satisfaction.

Unlock Your Potential

Smooth Onboarding, Big Rewards

Our onboarding process will help you and your company understand our services better.

Our educational videos and training links can be beneficial for your employees to use to close more deals and assist in the hand-off of our services to your clients.

During this onboarding process, we also discuss deliverables, timelines, terms of the engagement, and onboarding package pricing.

Seamless Integration

Implement & Connect for Success

Following our consultation and onboarding, an agreement is finalized, and signatures are collected, acknowledging the chosen onboarding package and expectations of business volume over the next 12 months.

At this time, we will discuss the integration of your solar clients into our CRM.

Once your clients are integrated into our system, our team will promptly contact them via, Phone, Email and SMS to schedule their consultation and provide the following steps to secure their tax benefits.

Sustaining Momentum

Unmatched Support, Lasting Partnership

Our partnership doesn't end with implementation.

We're here to provide continuous support, regularly monitor progress, gather feedback, and make necessary adjustments to ensure the desired outcomes are being achieved.

Transparency, team-work, and collaboration are key to a successful partnership and are part of our core values.

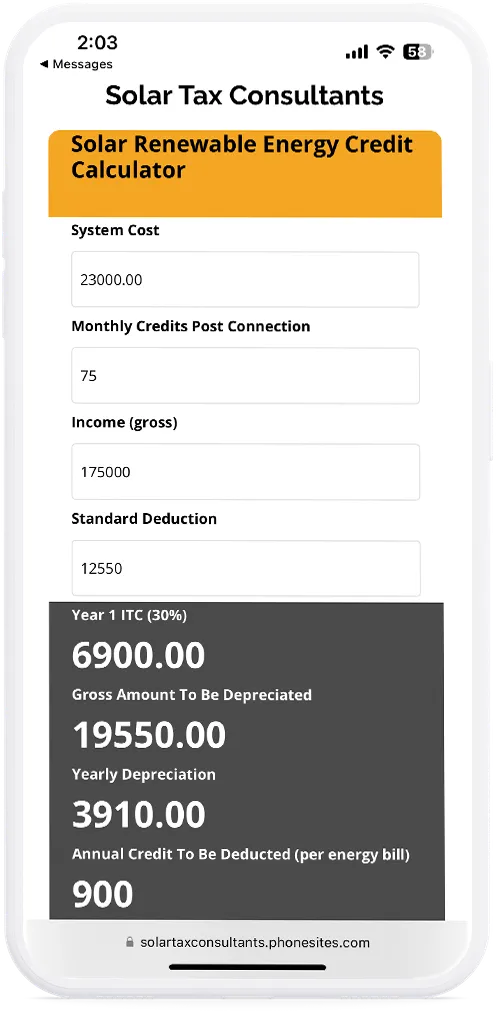

Empower Every Estimate

Introducing Our STC Savings Estimator

Instantly Estimate Savings

Provide real-time, accurate estimates of potential STC savings to your customers. Enhance your consultations with data-driven insights that can make your proposal irresistible.

User-Friendly Design

Our calculator is designed to be intuitive and easy to use. You don't need to be a financial whiz to understand the numbers; clear graphics and simple language make it accessible for everyone.

Hassle-Free Access

Our STC Savings Estimator is web-based, meaning you can access it anywhere from a web browser. There's no installation, no downloads—just instant, convenient access to empower your sales presentations.

WHY YOU NEED THIS

Before vs After lorem ipsum

Negative list lorem ipsum dolor elit.

Negative list lorem ipsum dolor elit.

Negative list lorem ipsum dolor elit.

Negative list lorem ipsum dolor elit.

Negative list lorem ipsum dolor elit.

Positive points lorem ipsum dolor.

Positive points lorem ipsum dolor.

Positive points lorem ipsum dolor.

Positive points lorem ipsum dolor.

Positive points lorem ipsum dolor.

THE OFFER BREAKDOWN

Here's Everything You Get

Ideal for small-scale solar providers or companies venturing into the solar space. Get a total of 6 high-quality consultations that break down the complexities of solar tax credits, making the financials a no-brainer for your clients.

Designed for medium-sized solar firms aiming for rapid growth. Provide an enhanced value proposition to your clients with 12 expert consultations. Help them unravel the intricacies of the federal solar tax credit and boost your customer satisfaction ratings.

Our most comprehensive package for large-scale solar enterprises. Equip your sales team with premium sales support, maximizing client benefits and setting your firm apart as a leader in customer-centric solar solutions.

TESTIMONIALS

Client Success Stories

I didn't know how much I was missing until Solar Tax Consultants stepped in. Their expertise was priceless and saved me so much

- Emily Johnson

"The process was so smooth. Michaela handled all the complex paperwork and strategy, saving us thousands effortlessly."

- David Thompson

"I was skeptical but gave them a try. Their expertise of Andrew blew me away. Now, I'm confident in my solar investment."

- Laura Kim

STILL GOT QUESTIONS?

Frequently Asked Questions

How much can these tax incentives save my clients?

On average, clients can expect an additional 15-30% in tax savings through these incentives. This can significantly enhance the value proposition for your solar offerings which will allow you to close more deals, hold more profit per deal, and still help your client get way more value over your competitors.

How do these additional tax savings differentiate our solar company from competitors?

By offering a comprehensive solution that includes not only energy savings but also tax benefits, you provide a more attractive package to clients, lowering their overall acquisition costs and setting your company apart from competitors.

Can these services be offered to commercial clients as well?

Yes, commercial clients who have purchased or financed solar systems and have tax liabilities can also benefit from these services.

What steps do solar representatives need to take to help clients access these services?

Use our savings calculator to estimate the extra tax savings after configuring your initial quote. During the sales pitch, present your proposal with the additional savings. Make sure to explain how the additional tax benefits work and inform clients that they will be contacted by Solar Tax Consultants for a consultation.

Don't Miss Out On Savings

Navigate the complexities of solar tax credits with ease. Book a consultation today and boost your business performance & customer satisfaction.

Upgrade your Business Today!

Copyrights 2023 | Solar Tax Consultants™ | Terms & Conditions